আরও দেখুন

10.02.2026 12:55 PM

10.02.2026 12:55 PMAhead of the release of the key U.S. employment report, which will be published tomorrow, Wednesday, markets are generally showing consolidation, reflecting participants' reluctance to take excessive risks.

Why is market activity declining during this period?

First and foremost, this is due to the fact that continued confirmation of weakness in the U.S. economy through the publication of extremely low job creation figures could force the Federal Reserve to cut interest rates more aggressively in order to restore economic growth. Under current conditions, this is simply necessary—especially since, according to the consensus forecast, a further slowdown in the Consumer Price Index (CPI), or consumer inflation on a year-over-year basis, is expected from 2.7% to 2.5%. This report will be released as early as this Friday.

So how might the markets react to the data on the number of new jobs? I believe that if the figures come in line with expectations, this will only increase the likelihood of an earlier interest rate cut by the Federal Reserve. Market participants currently believe that the first rate cut could occur, for example, in June, followed by a second one in the autumn. However, continued negative dynamics in the labor market—and let me remind you that the expected number of new non-farm jobs in the U.S. economy for January is only 70,000, compared with a December increase of 50,000—could instead lead to the first rate cut as early as March, before the change in Fed leadership scheduled for April.

Of course, one might assume that the regulator will be wary of cutting rates before summer due to the possible return of rising inflation. On the other hand, delaying this process threatens to further worsen the state of the U.S. economy, which is already in a difficult condition.

Another reason for a renewed rate-cutting cycle in the spring could be politics. Ahead of the congressional elections this autumn, Trump may push for earlier monetary easing in order to appeal to his voters and maintain the dominance of Republican Party members in the legislature.

What can be expected in the markets today?

As for today's price action, it will most likely be characterized by anticipation of the employment report and, consequently, low market activity.

Daily forecast:

EUR/USD

The pair is consolidating near the 1.1915 level. A breakout above this level, against the backdrop of a weak employment report, could lead to a weakening of the dollar and, accordingly, a rise in the pair toward 1.2025. The level for opening buy positions may be 1.1925.

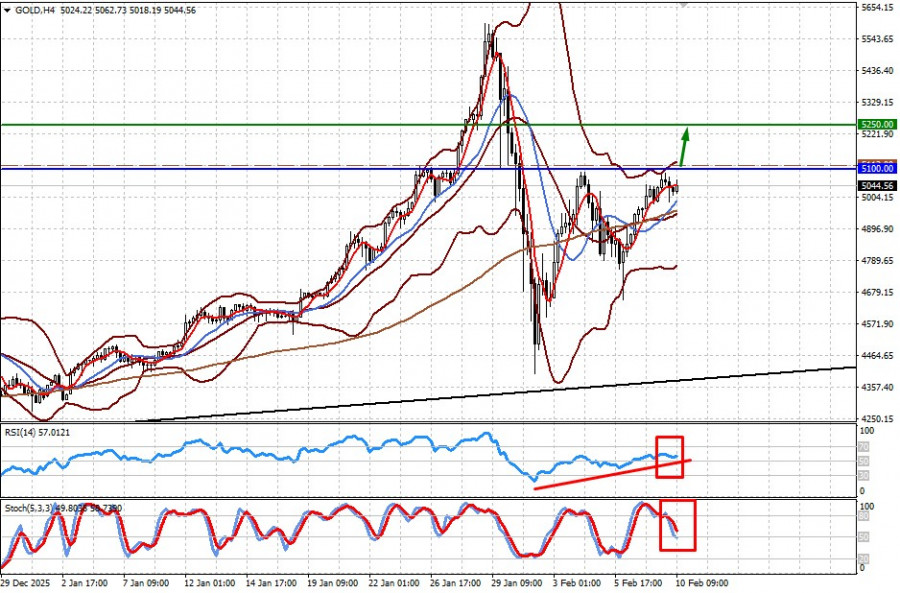

GOLD

The spot gold price is below the 5100.00 level. A weak NFP report could lead to increased demand for gold, whose price is already supported by geopolitical tensions in the world. Against this backdrop, it could rise toward 5250.00. A potential level for opening buy positions may be 5113.00.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।