Veja também

28.01.2026 10:07 AM

28.01.2026 10:07 AMYesterday, stock indices closed higher. The S&P 500 rose by 0.41%, while the Nasdaq 100 gained 0.91%. The Dow Jones Industrial Average, however, fell by 0.83%.

Global equity indices are posting their longest stretch of gains in a month, with tech stocks pulling Asian markets higher. The dollar stabilized slightly after concerns about unpredictable US policy had driven the currency to its weakest level in almost four years. Treasuries firmed modestly, with yields down one basis point to 4.23%.

Dollar stabilization, while a positive signal, remains fragile. Uncertainty about the US government's next steps on economic and trade policy continues to weigh on the currency. Moreover, the geopolitical backdrop remains tense. An escalation of conflict related to a possible US attack on Iran could at any moment upset the fragile balance in financial markets and trigger another wave of investor flight from the dollar into precious metals.

The MSCI All Country World Index rose by 0.2% and edged closer to a record high. Futures on US equity indices continued to hit fresh highs after the S&P 500 closed at a record on Tuesday. Nasdaq 100 futures received support after SoftBank Group Corp. said it is in talks to invest an additional $30 billion in OpenAI.

The key test today will be the Federal Reserve meeting, which will deliver its first monetary policy decision of the year, while the largest tech companies begin to report earnings.

In other markets, the price of gold reached a record high, topping $5,200 per ounce, extending a sharp rally driven by dollar weakness. Since the start of the year, the precious metal has risen roughly 20%, and earlier this week, it crossed $5,000 per ounce for the first time. Over the same period, silver has gained more than 50%.

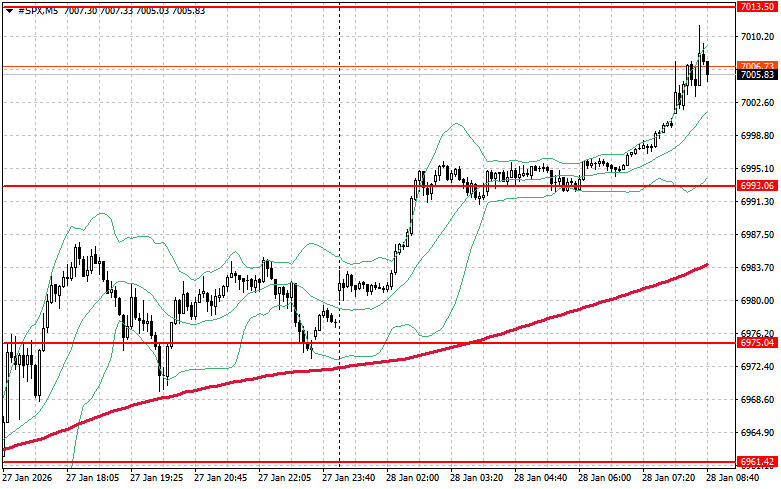

As for the technical outlook for the S&P 500, the immediate task for buyers today is to break above the nearest resistance level of $7,013. Overcoming that level would signal further upside and open the path to $7,033. An equally important objective for bulls is to secure control above $7,049, which would strengthen buyers' positions. In case of a downside move amid waning risk appetite, buyers must assert themselves around $6,993. A break below this level could quickly push the instrument back to $6,975 and open the way to $6,961.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.