Veja também

09.02.2026 06:27 PM

09.02.2026 06:27 PMThe EUR/GBP pair is gaining ground at the start of the week, supported by a stronger euro on the back of positive data from the eurozone, while the pound is under pressure due to escalating political tensions in the UK.

The euro is receiving momentum from a marked improvement in investor sentiment. The Sentix index in the eurozone jumped to 4.2 in February from -1.8 in January, marking its first return to positive territory since July. The survey also highlighted confidence in the German economy, driven by hopes for global stabilization underpinned by more resilient growth in the U.S. and Asia.

Markets are awaiting comments from European Central Bank (ECB) officials, including President Christine Lagarde, although these speeches are unlikely to alter the signals delivered at last week's monetary policy meeting. The ECB left its key interest rate unchanged at 2% for the fifth consecutive time, and Lagarde reiterated a data-dependent, meeting-by-meeting approach, offering no forward guidance on a specific rate path. A January Reuters poll shows that 85% of economists expect rates to remain unchanged through year-end.

Analysts at Societe Generale note a softening in the tone of some ECB members following the meeting: some emphasize the risks of disinflation stemming from Chinese imports, while others warn about the risk of a sharp appreciation in the euro and potential countermeasures by authorities. However, with rates close to neutral, the threshold for discussing further rate cuts remains high.

The pound is being undermined by a fresh political crisis in the UK. The resignation of Downing Street Chief of Staff Morgan McSweeney amid a scandal over the appointment of Peter Mandelson as U.S. ambassador has once again shaken confidence in the government, especially amid hints of a possible criminal investigation.

Expectations of Bank of England rate cuts are further weighing on the pound. The BoE recently confirmed its key rate at 3.75%, but the number of hawks on the Monetary Policy Committee was lower than expected. According to Dani Stoilova of BNP Paribas Markets 360, the next rate cut could come as early as March, followed by a pause, with the terminal rate seen around 3% by mid-2027.

From a technical perspective, if the pair manages to break above the 100-day SMA, bulls will gain full control of the market. Conversely, if prices drop below the 20-day SMA, the market will favor bears. Daily oscillators are mixed, indicating an ongoing battle between bulls and bears.

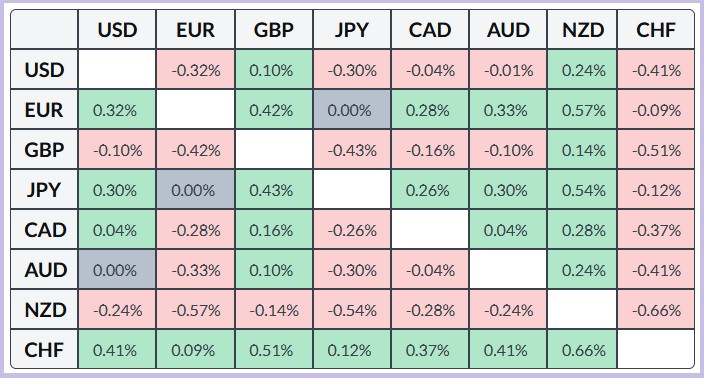

The table below shows the percentage change of the euro against major currencies today. The euro has shown the greatest strength against the New Zealand dollar.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.