Veja também

20.01.2026 12:25 AM

20.01.2026 12:25 AMAdults like children. Donald Trump is ready to start a trade war because he was not given the Nobel Peace Prize. After all, he supposedly ended more than eight wars. Now it's time to think about the interests of the United States. And buying Greenland is a matter of security.

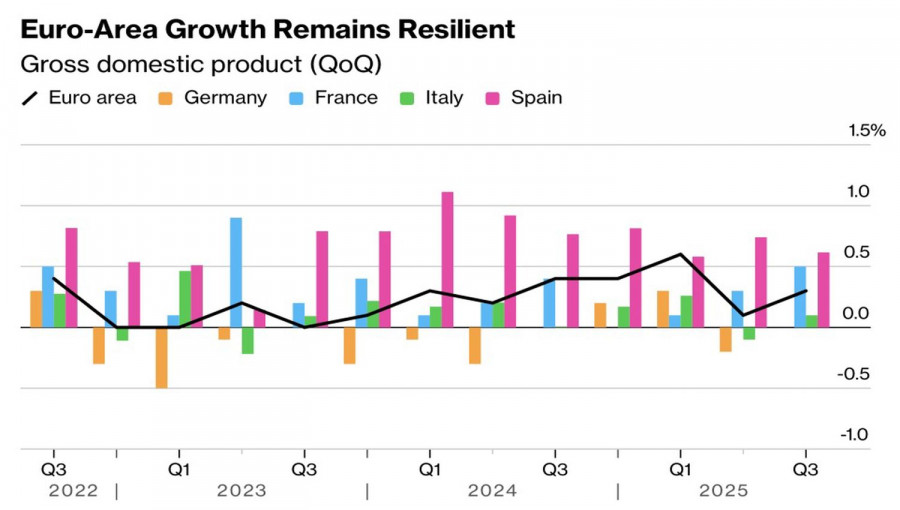

The reaction of EUR/USD to the threat of a 10% tariff against a number of European countries may have seemed strange. The major currency pair shot up like an express train. And yet, Goldman Sachs warns that new import tariffs could reduce real GDP in affected countries by 0.1–0.2 percentage points. Germany will receive the most sensitive blow. Until now, supported by fiscal stimulus and rising defense spending, the German and eurozone economies have shown surprising resilience.

However, investors have already seen this film. In April 2025, EUR/USD also rose in response to massive White House tariffs. And the reason was not European GDP but the American one. Rumors quickly spread in the market that import duties are an additional tax on the US population. Allegedly, importers will not reduce prices, so US companies will bear the costs. Whether they will raise prices and pass tariffs on to consumers or optimize costs is their business.

This assumption was supported by a study by the Kiel Institute for the World Economy. According to its calculations, Americans pay 96% of the tariffs, while everyone else pays 4%. That is, if import duties increased US budget revenues by $200 billion, practically all $200 billion was taken from the pockets of US households and companies.

It becomes clear why the US dollar rose amid expectations that the Supreme Court would cancel tariffs. In that scenario, $200 billion of fiscal stimulus would have flowed into the US economy. But Donald Trump decided otherwise. He is seriously intent on buying the largest island in the world — Greenland — for reasons of national security. Allegedly, the US must protect it from China and Russia. It does not matter how much money this will require or how badly the budget will suffer.

The president's tactic implies issuing large threats, then retreating after obtaining the desired result. Therefore, investors were not at all surprised by the intention to introduce 10% tariffs, then 25%. TACO will surely follow, or Trump always retreat. So it is not worth getting carried away buying the euro against the US dollar.

Technically, on the daily chart, EUR/USD shows a bar known as an Engulfing. The necessary conditions for the rally to continue are consolidation of quotes above support at 1.1615, followed by a successful assault of resistance at 1.1645. Only in that case does it make sense to switch from the previously used strategy of selling the major currency pair to buying it.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.